Checks+Balanced: How Pregnancy Changed Budgeting for a 25-Year-Old in Seattle

Even in a world where questions about menstrual cups and the ins and outs of sex are completely (and blessedly) normal, somehow the ever-ubiquitous use of money remains a touchy subject for many. People want to live their healthiest life ever, but—#realtalk—it can add up. Have you ever wondered how your colleague who makes less than you do (or so you think) can afford to buy a $5 matcha and a $12 chopped salad every day? Or how your friend’s budget allows her to hit up $34 fitness classes three times a week? It’s enough to make anyone want to ask, “Ummm, excuse me. How do you afford that?!?”

That’s where Well+Good’s monthly series Checks+Balanced comes in. By lifting the thick, tightly drawn curtain to expose how much women of varying income brackets spend on wellness, we’re spreading transparency and hopefully providing some inspo that’s possible to copy. Because no matter how much you make, it’s possible to cultivate healthy habits that work within your budget.

This month, Chelsea Foster, a 25-year-old geologist living outside Seattle, Washington, reveals exactly how much she spends on nonnegotiables (like rent and food) and healthy habits (like supplements and acupuncture) alike. Foster has PCOS (polycystic ovarian syndrome), and says sticking to her nutrition plan is key for managing her symptoms—but costs for the foods she relies on add up. She's also newly pregnant and says her budget has definitely changed as a result. Keep reading for an up-close-and-definitely-personal look at her finances.

{{post.sponsorText}}

Here, a 25-year-old geologist in Seattle, Washington, shares how she maintains healthy habits and adjusts for a new baby budget.

Chelsea Foster, 25, geologist, Seattle

Income: $62,500 per year. I'm a geologist, so generally what I do is clean up contaminated groundwater and soil. I test them and do remediation methods. I get to spend a lot of time outside, which is nice. My husband is an auto technician. He makes $150,000 per year, and we share most of our expenses.

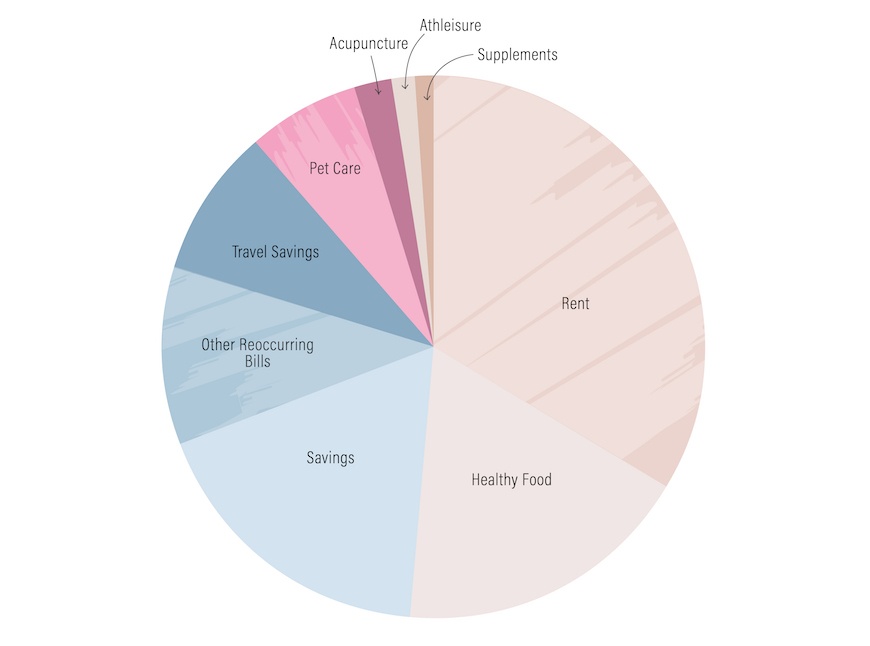

Rent: $1,889 per month. We rent a two-bedroom condo outside Seattle, and our tend is $1,889 per month. Now that we're starting a family, we've been house hunting and just found a place we really like, so a move in definitely in our near future.

Other reoccurring bills: $598 per month. We pay $60 a month for our electric bill and $50 for Internet. My work pays for a portion of my cell-phone bill, so I end up paying $125 out of pocket. My husband owns his car—and a motorcycle—but I still have a payment on mine, which is $363 a month. We also have Netflix and Spotify, but Netflix we get for free through T-Mobile, and our Spotify subscription was a gift from a friend.

Food: $1,000 per month. Eating whole foods has been helpful managing my PCOS symptoms, so I do work that into our budget. We prioritize buying high-quality meats and local foods. Recently, we bought a quarter of a cow from a local family farm, which was $500. We got it all frozen and all different types of cuts. We also have a subscription to Thrive Market, which is $60 per year, not including the items we buy. Otherwise, I do almost all my grocery shopping at Trader Joe's and pick up a few specialty items at Whole Foods. Between the locally sourced meat, Thrive Market, Trader Joe's, and Whole Foods, we spend $800 a month on groceries. I pack a lunch to work, but my husband typically buys his lunch, and we eat out on the weekends. I would average our eating-out costs at $50 per week.

Fitness: $0 per month. My husband and I used to belong to a CrossFit gym, which was $280 per month for our two memberships. We got tired of paying for it, so we actually built our own home gym. We got a squat rack, kettlebells, a medicine ball...everything we need for the cost of what would essentially be a year of paying for CrossFit. So now I work out from home and my fitness spending has decreased to zero.

Supplements: $60 per month. I take supplements every day, including vitamin D, fish oil, liver support, and digestive enzymes. Especially now that I'm pregnant, it's become even more important, and I have more to take now. I also use tinctures, and herbal teas—all from a local herbal store. I added up the costs of my supplements and tinctures the other day, and it came out to $2 to $3 per day.

Acupuncture: $120 per month. I do acupuncture twice a month, and it's $60 a visit. I started doing it to help with fertility, and it really helped me feel more calm. Now, it's a self-care thing for me.

Athleisure: $900 per year. I buy new activewear for my husband and myself about once every three months, spending about $200 on new leggings, sports bras, or workout tops. One of my favorite brands is Born Primitive, which has really fun prints and colors.

Pet care: $380 per month. My husband and I have two rescue mutts. One dog eats dry dog food, but our other dog is so picky! He only eats from The Farmer's Dog, which is a subscription service for freshly made and delivered food, but since we noticed a big improvement in his health issues since feeding him this food, the cost seems worth it. In total, we spend $200 a month on our dogs, including The Farmer's Dog subscription, dry dog food, and other treats. My husband and I also contribute $100 a month to pet savings, because we want to be prepared in case one of them requires medical care.

Travel: $500 per month. My husband and I have a savings account for travel, and we contribute $500 per month toward it. It's reserved for bigger trips, like to Alaska, Hawaii, or somewhere international. When we take a trip like that, it generally costs more than $5,000, so having a dedicated savings account for that helps us see more places.

Savings: $1,000 per month, personal; $7,000 combined with husband's income. My husband and I both contribute to our respective employer's retirement fund to get the maximum company match. I contribute 15 percent, and he does 10 percent. We also contribute to health savings accounts, our pet fund, travel fund, and a home savings account. We always keep a savings account with three-to-six months worth of living expenses, just in case something unusual happens. Now that I'm pregnant, I'm using some of our savings to budget for the medical appointments and some of the other baby-related expenses that come up. I'm not sure yet how having a baby will affect our budget, so I'm doing my best to manage it as it comes.

Want to be featured? Email emily@www.wellandgood.com. Plus, here are some tips for talking to your partner about money in case you don't feel like you're on the same page.

Loading More Posts...