A Mother of 3 Teens Shares How the Pandemic Has Affected Her Grocery Bill, Among Other Expenses

Our editors independently select the brands they recommend. Making a purchase through our links may earn Well+Good a commission.

It's widely accepted to talk about fitness, healthy food, and self care. But conversations about financial wellness—which is crucial to well-being—are in large part still very hush-hush. Even in a time when no topic seems to be off-limits, talking about money still has a stigma attached. Well+Good's Checks+Balanced series aims to help end that stigma. Each month, one person shares their income, living expenses, and what they spend on their favorite healthy habits.

This month, Gina, a married mother of three teens who runs a blog focused on money-saving tips for families, gets real about what her budget for raising teenagers looks like. And during the pandemic, that's meant a much bigger grocery bill, among other things. Below, Gina outlines what her expenses are each month, and how she budgets for her family.

Keep reading to see how Gina balances her budget for raising teenagers with affording the healthy habits that are important to her.

*Gina, 48, blogger, Burke, Virginia

Income: $60,000/year. Combined income: $232,000/year. My main source of income is through my blog, which focuses on money-saving tips for families. I also coach other bloggers about how they can build their brand and generate income. I have a business partner, and we used to do in-person coaching events as well, but we switched to offering them virtually during the pandemic. Pivoting to online was actually good for business because we didn't have to pay for travel anymore, which can be expensive. Between blogging and my coaching business, I make about $60,000 a year. My husband is a lawyer and makes $172,000 a year.

{{post.sponsorText}}

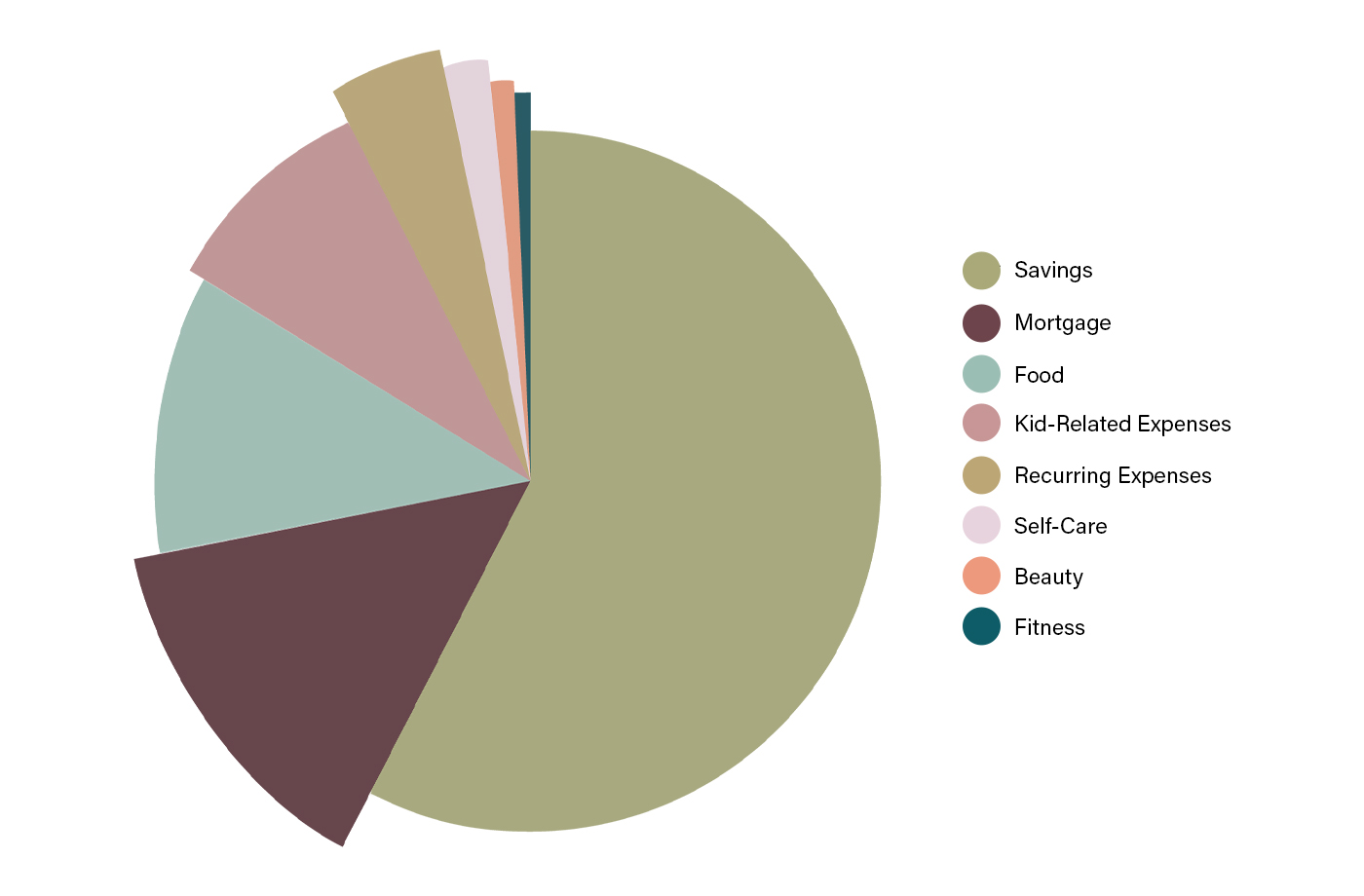

Mortgage: $2,150/month. We own our home, which is a townhouse, and our mortgage is $1,950 a month. Insurance and the HOA fees are another $200 a month.

Savings: $8,700/month. My husband and I used to be $87,000 in debt, mostly from my husband's law school student loans. We devoted 45 percent of our income to paying off the debt and now that it's paid off, we put that 45 percent to several different saving buckets, including an emergency fund and retirement fund. We have three teenagers, and the oldest is graduating high school soon, so saving for college is top of mind for us, too. We have a savings account just for that, contributing $1,000 a month. We have another savings account for new cars, since all our kids are getting to be of driving age, too. We contribute $600 a month to the new-car fund.

Recurring expenses: $661/month. My husband and I both paid off our cars and we've hardly spent any money on gas lately, because we haven't really been going anywhere during the pandemic. Our utility bill is about $310 a month, and we pay $109 for Wi-Fi and a landline, which we actually still use. Our cell phone bill is $133 a month, which covers five phones. We also have a lot of subscription services—a lot. My husband signs up for all these free trials and forgets to cancel! Some of them are Netflix ($14 a month), Hulu ($12 a month), Disney Plus ($8 a month), and then some lesser-known ones like VRV ($10 a month) and Funimation ($6 a month), which have Japanese anime and my kids love that. We also have DC ($8 a month) and Marvel ($10 a month) subscriptions, which allow you to read comics online. The kids have a subscription for Xbox ($10 a month), Nintendo ($4 a month), and Playstation ($10 a month). The main one I personally use, besides Netflix and Hulu, is our New York Times subscription ($17).

Kid-related expenses: $1,500/month. We budget $1,500 a month for any expenses related to our three kids. For example, one of my kids takes viola lessons, which is $150 a month. Another one of my kids is learning Japanese and since her classes have been virtual, we have been paying $100 a month for the virtual program. Our biggest extracurricular expense is my son's competitive swimming, at $700 per month. This bucket also includes things like new clothes, haircuts, and other needs that come up—there always seems to be something.

Food: $1,700/month: Having all three kids at home during the pandemic while they do virtual school has definitely made our grocery bill go up a lot. Before the pandemic, I would spend $600 a month on groceries, and it's gotten up to $1,200 a month now. This includes food for our dog, too. I do most of my grocery shopping at Aldi because they offer good discounts. I don't follow any specific type of nutrition plan, per se, but I do try to stick with buying whole foods and not too many items that are heavily processed. I make homemade mac-and-cheese, tacos, pasta, chicken, and fish. We eat vegetarian once a week. We also use HelloFresh ($300 a month) to make mealtime a bit easier. I've tried five different meal subscription services, and this is my favorite one. It's a way to try cuisine or ingredients I wouldn't normally try. We also spend about $200 a month on takeout, because sometimes I just don't have the energy to cook.

Fitness: $50/month. I get a lot of exercise walking our dog every day. I like taking walks with my friends and neighbors, too. Not being able to be social during the pandemic has been really hard for me, so sometimes I'll text a friend to see if they just want to go for a walk. It's a nice way to catch up while doing something active. Before the pandemic, I used to belong to a yoga studio and go to classes four to six times a week. Now, I pay $50 for an online membership the studio has so I can do virtual classes. I also find free yoga videos on YouTube to do. We have an elliptical, so I'll do that sometimes.

Beauty: $1,200/year. I'm not really big into beauty. I do get my hair cut six to eight times a year, which is about $125 each visit. During the pandemic, I didn't feel safe going to the salon, so I cut my own hair. I even dyed it purple, just for fun. My teens were not into it. I spent a lot of 2019 taking care of my mom at the end of her life, and I used to go get manicures, pedicures, and do face masks as a way to take care of myself during what was a very difficult time. I was spending about $200 a month, but I haven't done any of that during the pandemic. I don't even wear makeup anymore. I just put on my face moisturizer and that's really it. Once I have the vaccine, I'll return to regular haircuts and the occasional pedicure.

Self care: $200/month. Before the pandemic, I used to get a massage every month. I also used to go to a movie once a week by myself; that was the major self-care habit I would prioritize for myself. I also used to see a therapist, but she stopped taking my insurance, so I stopped going. Combined, those self-care practices cost $400 a month. Now, I use BetterHelp, which offers virtual and text therapy. It's been hugely beneficial for me—especially since my mother died and I'm still working through that grief. It's $200 a month and not covered by my insurance, but it's been vital for my mental health and self care. Once I get the vaccine, I think I'll start getting massages and going to the movies again. It will be nice to get back to the wellness habits that were important to me before the pandemic.

*Last name has been withheld.

Want to be featured in Checks+Balanced? Email emily@www.wellandgood.com

Oh hi! You look like someone who loves free workouts, discounts for cult-fave wellness brands, and exclusive Well+Good content. Sign up for Well+, our online community of wellness insiders, and unlock your rewards instantly.

Loading More Posts...