Checks+Balanced: How Going Back to School for a Career Shift Affects a 29-Year-Old’s Wellness Budget

Even in a world where questions about menstrual cups and the ins and outs of sex are completely (and blessedly) normal, somehow the ever-ubiquitous use of money remains a touchy subject for many. People want to live their healthiest life ever, but—#realtalk—it can add up. Have you ever wondered how your colleague who makes less than you do (or so you think) can afford to buy a $5 matcha and a $12 chopped salad every day? Or how your friend’s budget allows her to hit up $34 fitness classes three times a week? It’s enough to make anyone want to ask, “Ummm, excuse me. How do you afford that?!?”

That’s where Well+Good’s monthly series Checks+Balanced comes in. By lifting the thick, tightly drawn curtain to expose how much women of varying income brackets spend on wellness, we’re spreading transparency and hopefully providing some inspo that’s possible to copy. Because no matter how much you make, it’s possible to cultivate healthy habits that work within your budget.

This month, meet Madelana, a 29-year-old living in New Jersey who's in the midst of a career change from media to becoming a chef. Scaling back her full-time client services job to part-time in order to attend culinary school led her to cut back on expenses, but living healthy remains a priority even while she's budgeting for school. In fact, her whole Instagram account, @itscalledbalance, is devoted to her wellness philosophy. Keep reading to see her spending habits.

{{post.sponsorText}}

Here, a 29-year-old living in New Jersey shares how she prioritizes wellness habits while budgeting for school to become a chef.

Madelana, 29, part-time client-services employee/current culinary student, Weehawken, New Jersey

Income: $24,000 per year. I worked in media for 10 years, most recently doing client services at an ad agency. In the past few years, I found myself feeling uninspired and thinking more about going to culinary school and becoming a chef. I'm 29, so I thought, if I'm going to do it, now is the time. My job has been really understanding, letting me stay on part-time, working 15 hours a week, mostly remote. I get paid $1,000 every two weeks from my agency job. I took out loans to pay for culinary school, which was a bit soul-crushing because I just finished paying off my college loans a year and a half ago.

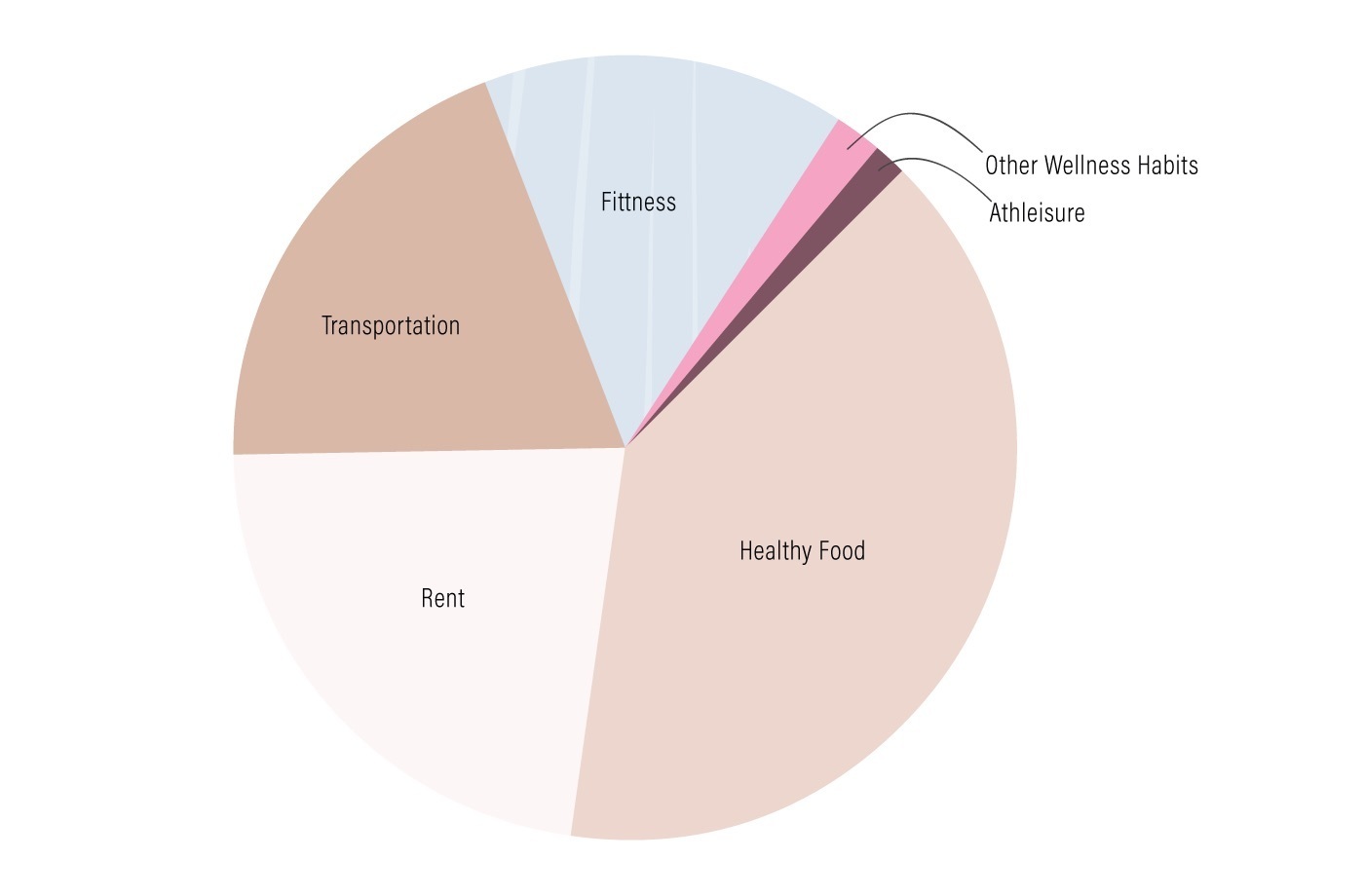

Rent: $325 per month. I got super lucky with my apartment: I used to live in Los Angeles and moved back to New Jersey when my sister's friend's was moving out of her rent-controlled apartment. The total rent is $650 a month, but my boyfriend recently moved in, so now I just pay half of that. It's a tiny studio, but the price is right.

Transportation: $379 per month. My job and culinary school are both in Manhattan, and I spend $234 a month on my NJ Transit card and MTA unlimited Metrocard. I also have a car and pay $145 a month in car insurance.

Other reoccurring expenditures: $137 per month. My boyfriend and I split our cable and utilities bill, which comes out to about $80 a person. I also have Netflix ($12/month) and Spotify ($10/month), so I pay for that, and I give $35 a month to charity: water.

Food: $670 per month. Ironically, given that I'm in culinary school, the last thing I want to do when I get home is to cook, so I'm spending less on groceries—only about $40 a week to keep some food in the apartment. Dinner is usually takeout, a smoothie, or something I can make quickly based on what I have at home because I'm too tired to cook. While I don't label my nutrition plan, if I had to, I'd say it most closely resembles the Mediterranean diet. I love bread and fresh vegetables. Fortunately, I get lunch for free every day at school because someone is always tasked with making a family-style meal for everyone.

I budget $100 a week for eating out. I'm 100 percent Italian and am a total pizza-and-wine girl, but my boyfriend likes more Asian-inspired foods, so we sometimes butt heads on where to eat. As for alcohol, my boyfriend and I are both into beer—specifically IPAs—so I would estimate that I spend about $40 a month on that.

I get up super early to do work for the agency from 6 a.m. to 8:30 a.m. before I go to school, so I started buying coffee every morning at the coffee shop in Soho where I post up with my computer. (Because my boyfriend and I live in such a small studio, I would wake him up if I worked from home that early.) I spend $70 a month on coffee at the cafe. I used to feel guilty about it, but you know what? It's my me-time, and I'm worth it.

Fitness: $250 per month. I currently spend $250 a month to belong to Equinox, but I'm considering canceling my membership in order to save money. Fortunately, I love to run, which is free. Even now, when I think about how I'm having to cut back my finances, I feel happy that running is always available. All I need is some sneakers.

Athleisure: $260 per year. I don't buy a lot of athleisure or workout clothes, but I do buy a new pair of Nike sneakers about once every six months because I go through them so fast.

Other wellness habits: $137, 3 times per year. Before I started culinary school, I used to get gel manicures and pedicures every two weeks, but I'm actually not allowed to wear nail polish at culinary school, so that's no longer a thing. I don't spend a lot on beauty products or treatments, but I do use Vital Proteins ($43/tub) or Bulletproof ($35/tub) collagen every day, so that is an expense for me. I've also been using a lot of CBD lately. There's this brand I really like, Populum, and I use their oils ($59/bottle) every night before bed. Something else that helps with my anxiety is a weighted blanket I have from Gravity, which a friend gave me. It feels like someone is giving you a big hug and is really comforting.

When it comes to self care and stress relief, I really find that it doesn't take much to feel good. All I need are some candles, sweatpants, and a face mask, and I'm good. Just having 10 minutes to myself to unwind at the end of every day makes a difference. I don't make the time every day, but when I do, I definitely notice a change.

Want to be featured? Email emily@www.wellandgood.com. And if you're curious about more wellness budgets, see how one 27-year-old affords her favorite healthy habits—while budgeting for a wedding. And how much a 30-year-old in Toronto making $60,000 a year spends on wellness.

Loading More Posts...