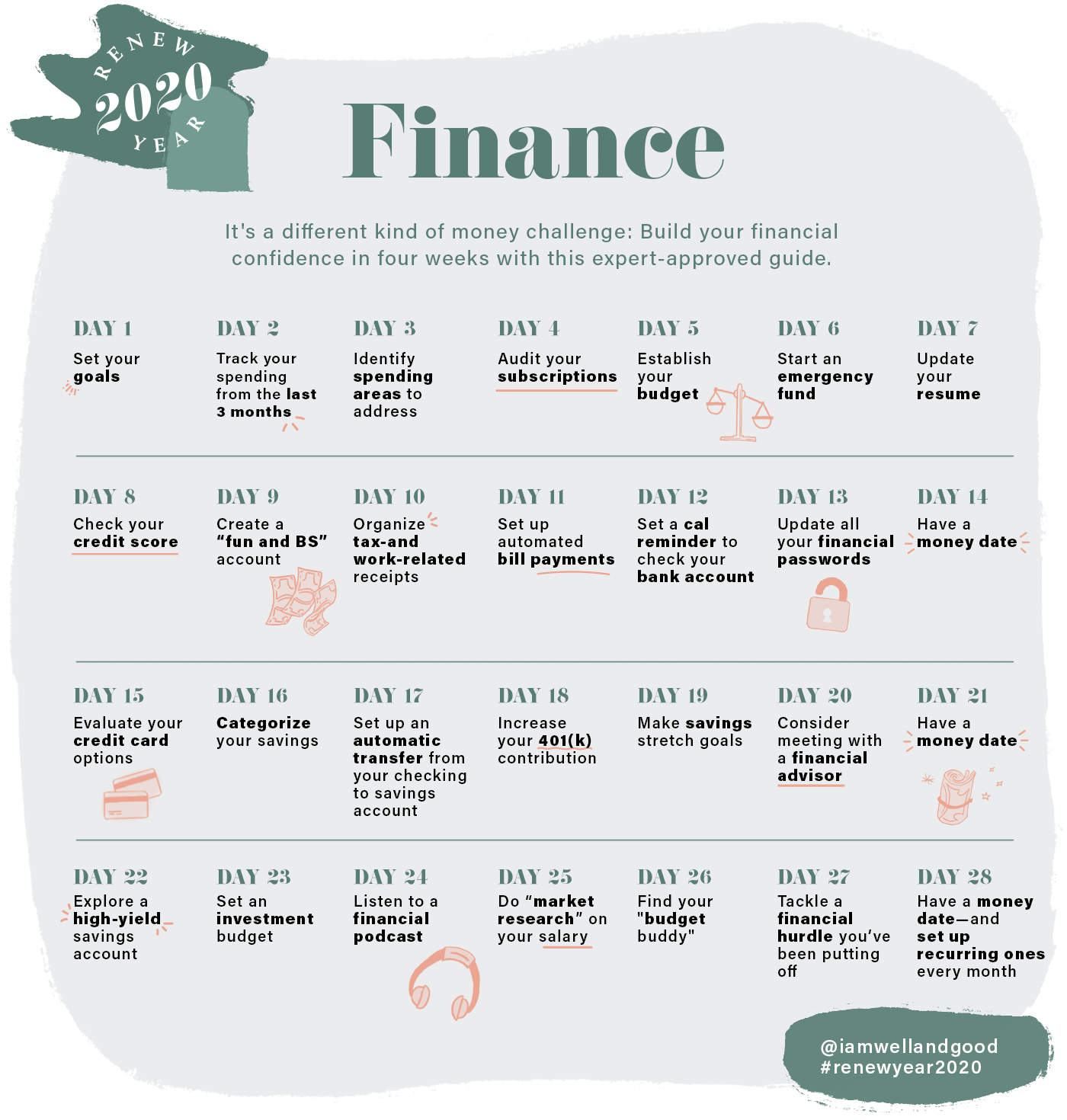

Get Your Finances on Track With Our 28-Day Financial Wellness Challenge

The good news is, this is the time to get back on track, and we’re here (armed with some of the best budgeting experts in the biz) to help. This four-week-long money challenge is thoughtfully constructed to set you up for financial success by taking inventory of your spending and making realistic-yet-impactful changes that will help you meet your goals. We know the idea of tackling your finances can sound overwhelming, which is why the challenge is broken down into daily “mini” tips, all of which are totally quick and manageable.

You’ll first start the 28-day challenge by taking stock of all of your finances—your income, spending habits, debts, the whole nine yards—before moving into ways to optimize your spending, boost your savings, and get smarter about investing. No matter your money knowledge, there’s something that you can benefit from.

The challenge kicks off on January 5; join us by signing up for our special email that will deliver all the plans to your inbox* (in the box below) and downloading the tasks onto your personal calendar. By the end of the month, you’ll not only be a lot more organized, you’ll also be more on track to meet your unique money goals. Bet on it.

Keep reading for the full 28-day financial wellness challenge:

Day 1: Set your goals

Financial Gym founder and CEO Shannon McLay suggests making your money goals meaningful and realistic. “The key to making goals that are actually achievable is breaking them down into smaller goals,” she says. “The same way having the overall goal of running a marathon has to start with running shorter distances first, the way you reach your big money goals is by setting smaller benchmarks first.”

{{post.sponsorText}}

Spend time today thinking about—and jotting down—those big goals you want to achieve in 2020. (Saving enough for a down payment on a home? Increasing your retirement savings? Going on that dream vacation?) Then, hone in on one, and break it down into more manageable steps. If your goal is to pay off your student loans, for example, set a smaller goal of paying X amount above the minimum—whatever works for your budget—to make it go from nebulous to tangible and doable.

Day 2: Track your spending from the last 3 months

In order to stick to those goals, you have to understand how you’re currently spending your money. The easiest way to do this is by pulling up your bank account online to view your transactions from the past 90 days.

Then, make an Excel doc or plug your expenditures into an app like Mint or Monefy in order to categorize your spending. Which expenses are fixed—like your rent, car payments, and utilities—and which are flexible? Once you have a clear idea of where your money is going, you can hone in on the areas to prioritize in order to better meet your goals.

Day 3: Identify spending areas to address

Now that you have your spending right in front of you, take a few minutes to assess if there are any areas you don’t feel great about. McLay says that seeing your spending in black and white can often be surprising: You may not realize how much you’re cumulatively spending on spin classes or lattes until you see the numbers in front of you.

We’ll save making a budget for later this week (baby steps!), but in the meantime, think about how your spending and saving habits are currently aligning with your goals. Maybe you feel like you’re putting a lot of money into your savings, but can see now that $50 each week won’t let you take that trip until next year. How can you reduce spending in other areas in order to increase your weekly savings?

Day 4: Audit your subscriptions

“Many people often find they have automatic payments for subscriptions, some of which they don’t even use,” says Brightwater Accounting founder Cathy Derus, CPA. Spend 15 minutes today assessing all your various subscriptions—magazines, streaming services, apps you signed up for and forgot to cancel—and think about if you’re still into ‘em or if there are any you want to get rid of. “They can seem like a small monthly payment when you sign up, but they add up,” Derus says.

Derus also says this is a good time to see when any subscriptions, like your phone or cable plan, are ending. “Set a Google reminder for when your subscription is set to renew and instead of auto-renewing, use this time to negotiate a new rate,” she says. “If the company is scared you’ll leave, they’ll often offer you a deal.”

Day 5: Establish your budget

Okay, here we go. If you groaned when you read today’s activity, we hear you. Budgeting is rarely fun—but if you’ve done your homework (and if you’ve been following the plan, you have), it can be painless.

When it comes to creating a budget, Derus says there’s no one-size-fits all formula, but a good place everyone can start is identifying what your priorities are and figuring out how much of your paycheck you can devote to each one. “Establishing what your goals are makes it easier to stick to a budget because it serves as a reminder of what you’re saving for,” Derus says.

And remember, you don’t have to go it alone. Apps and software like You Need a Budget can be your best friend (it’s a favorite of financial expert and So Money podcast host Farnoosh Torabi). And for newby budgeters looking for a more detailed breakdown (no shame!), we recommend How to Not Suck at Budgeting: The Definitive Guide from The Hell Yeah Group, an organization that provides tools and resources for navigating your finances.

Day 6: Start an emergency fund

No matter your individual financial goals, it’s important to be putting money each month into an emergency fund. "Half of Americans can't accord a $400 emergency expense, whether that's a dentist visit or a car-related expense,” says Dana Marineau, vice president of brand and communications at Credit Karma. “That's why having an emergency fund is so important.” The general goal is to build up enough savings to meet your basic needs for three to six months if you were to ever lose your job. Today, look at your finances and spending history in order to establish what that fund should be, and come up with a percent of each paycheck you feel comfortable devoting to your emergency fund until it’s full. Then, don’t touch it… unless it’s an emergency, of course.

Day 7: Update your resume

This might not seem directly related to money, but your income provides the foundation for all your financial choices. And, trust us, nothing adds stress to an already stressful situation than having to scramble to update your resume when you need to—either because you lost your job or a timely new opportunity presents itself.

Also, the exercise of quantifying your career accomplishments on paper—that you grew revenue 50 percent in the past year, or manage a team of five people—can also help show you your worth. This will come in handy when it’s time to ask for a raise or advocate for a promotion.

Day 8: Check your credit score

Checking your credit score is something many people don’t think to do unless they’re about to make a major purchase, but McLay says it’s a good idea to do this quarterly. “You want to do these check-ins to make sure no one is using your personal information that could affect your score. This is a way to fix any errors.” It’s also a way to see whether you’ve fallen into any habits that may be impacting your score, like carrying a balance each month or failing to make the minimum payments.

McLay recommends using Credit Karma to check your score because it’s free, but many credit cards now have free score-checking features built into their apps. (In case you’re wondering, using a tool like Credit Karma to check your credit score won’t harm your score—it’s only “hard inquiries,” like from the bank, that have an impact.)

Day 9: Create a “fun and BS” account

Today, create a separate checking account (with its own debit card) to be used for the fun part of your budget—nights out, shopping, that sort of thing. Paco de Leon, founder of The Hell Yeah Group, calls this her “fun and BS” account. “When somebody’s like, ‘Hey, do you want to go out and have pizza and tequila shots?’ I’m like, ‘Okay, let me check my allowance,’” she shared with Well+Good at a recent TALKS event. “This is what I do to protect myself from myself.”

“Having a ‘fun’ spending account can be important because that way, if you have a bad day and want to treat yourself, you can do it without feeling ‘bad’ or ‘guilty’ because you have a designated account devoted to it,” McLay says. The size of the “fun” account is going to vary from person to person, but she recommends devoting at least a small portion of each paycheck to this bucket.

Day 10: Organize tax- and work-related receipts

McLay says most people typically don’t need to keep receipts for every single purchase, but she recommends hanging onto the ones that have to do with anything tax-related (like charitable giving) or something you can get reimbursed for through your workplace. “Set up a folder [digital or paper] for receipts related to charitable giving and anything else you plan on claiming [as a deduction],” Derus adds. If you make your payments online, make a subfolder in your inbox to file everything into there. It’ll make your life a bit easier come tax season to have all that paperwork together.

Day 11: Set up automated bill payments

Setting aside 20 minutes to schedule automatic payment of your electric, phone, cable, and student loan bills (to name a few) can save time and money anxiety the whole rest of the year. “Some people may not be able to set up automated payments on all their bills—you have to do what’s best for your budget—but I definitely recommend automated payments for your credit card bill at least,” McLay says. “Automate it to meet the minimum, then if you have any leftover money you want to contribute, you can do that manually.” Derus says she sets a cal reminder for herself to pay any bills that don’t automate, so that nothing falls by the wayside.

Day 12: Set a cal reminder to check your bank account

With your automatic payments in place, it can be easy to shift into a “set it and forget it” mentality, but it’s important to still keep eyes on your bank and credit card accounts. Derus recommends checking your bank account balance manually at least once a month to check in with yourself and ensure there haven’t been any unauthorized charges. “I tend to tell people to check their balance on an ‘as needed’ basis, but there are also apps and settings that can tell you when your balance goes below a certain number,” she says. “That can serve as a reminder that you’ve maybe overspent that month or you need to transfer some money from your savings to cover any upcoming bills.”

Day 13: Update all your financial passwords

It’s virtually impossible to remember all your passwords for everything. Unfortunately, keeping them all written down on a Post-it next to your laptop isn’t exactly secure. McLay recommends using a password app, like Dashlane or Keeper. That way, you only need to remember the password for that. Use this day to give all your financial passwords—like your online bank and 401(k) log-ins—a secure refresh, then save ‘em in your password protector. Done and done.

Day 14: Have a money date

Money dates are time you carve out to check-in with your finances—or just tick off a money-related task you’ve had on your mind. De Leon refers to this as weekly finance time, and says even just 15 or 20 minutes makes a difference. “People kept trying to give me this weird excuse that they didn’t have time [to manage their money],” de Leon said at Well+Good’s October TALKS event, “and let’s just nip that right in the bud and make the time. When you allow yourself to focus on something, you’ll be pleasantly surprised at how it expands.” You can log into your bank accounts and look for unusual spending, or reach out to HR and increase your 401(k) contribution if that’s something you’ve wanted to do. Or, use this time to talk about your finances with your S.O. Most importantly, appreciate the steps you’ve already taken this month. You’re doing great.

Day 15: Evaluate your credit card options

Virtually any time you walk into a store or step onto a plane, credit card offers are dangled in front of you. As a general rule, McLay says to stay far away from store credit cards. “They just encourage more spending!” she says. But aside from that, she says if you are a responsible bill-payer, having a credit card from a bank or airline can help build your credit and also offer rewards.

If you don’t have a credit card—or are interested in opening a new one with better benefits— use this day to research what’s out there. If you travel a lot, for example, see what cards offer points without blackout dates. (Hint: You can find more tips for wisely using credit card rewards to help pay for travel here.) If you do have a lot of credit cards—particularly the store ones McLay isn’t a fan of—think about what steps you can take to reduce your reliance on a variety of cards to make your budgeting more streamlined. (It’s important to note that quickly canceling a number of cards at once can negatively impact your credit score. More details on that here.)

Day 16: Categorize your savings

Many people have just one savings account that they draw everything from—their emergency money, their travel money, etc. But it’s actually a good idea to have multiple savings accounts (including the above-mentioned emergency fund) to keep money earmarked for specific purposes. “When people actually name their savings accounts whatever it is they’re saving for, they’re more likely to meet their goal,” McLay adds.

Today, open different savings accounts for each of your savings goals and give them different names. “When you do this, it makes it seem like less of a sacrifice to not spend money in the moment because you’re putting it toward something specific,” McLay says. (Just be sure to read the fine print before opening a new account to make sure it doesn’t require a minimum balance or have a fee.)

Day 17: Set up an automatic transfer from your checking to savings account

McLay recommends setting up automatic withdrawals to your different savings accounts because it takes away the work. That way, you’re growing your savings without even having to think about it.

Day 18: Increase your 401(k) contribution

Today, you’re checking in on your retirement savings. “When it comes to contributing to your 401(k), you at least want to do the percentage your company matches, if that is something offered to you, and if that’s within your financial means,” says Marineau. Spend 15 minutes today simply logging into your 401(k), IRA, or other retirement investment account and seeing where you’re at. Are you happy with how much you’re contributing? Do you need to make any adjustments?

If you haven’t yet signed up for a retirement investment account, there’s no time like the present! Brush up on your options to choose the one that best suits your individual situation, and then automate those payments.

Day 19: Make savings stretch goals

At this point, you may feel overwhelmed by all the different savings needs out there: your emergency fund, retirement, saving for a goal, etc. And McClay says it’s not uncommon to feel like you have nothing left over to save after you pay their recurring expenses. ”A lot of people say, ‘I don’t have money. It’s just gone,’” she says.

If saving a set amount of money feels daunting or impossible, try instead creating stretch savings goals for yourself over the year. Shannah Compton Game, a certified financial planner, recommends breaking up the year into three-month chunks and slowly increasing how much of your take-home pay you save each quarter. “Plan out your year spread where your end goal is maybe 5 to 10 percent,” she previously told Well+Good. Even 1 percent is okay, she said, as long as you’re saving something.

Day 20: Consider meeting with a financial advisor

You’ve been doing a great job this month getting your financial ducks in a row. But it can be worth talking to a financial advisor for extra guidance, especially if you’re going through a big life change (marriage, starting a business, buying a home, etc). A financial advisor looks at your finances holistically to help you strategize the best way to meet your big-picture goals. And no, you don’t have to be an heiress to hire one. Rates vary, but according to Torabi, they typically charge 1 percent of your underlying assets per year.

If you’re interested, search for one using reputable services like the National Association of Personal Financial Advisors, and be sure to interview them to see if you like them before hiring them.

Day 21: Have a money date

Just like your last money date, use this time to take care of any unpaid bills and check in with how you’re doing when it comes to meeting your budgeting goals. You’ve made a lot of changes this month, so don’t be surprised—or freaked out—if you have to make some tweaks.

Day 22: Explore a high-yield savings account

“A high-yield savings account is a bank account that earns you a higher interest rate for deposits than a traditional savings account,” explains best-selling author and money expert Nicole Lapin. “Online banks are able to offer this because they don’t have the overhead costs traditional banks do.” This can help you get more out of your savings without having to do anything besides put money away. And again, when checking out your options, be sure to see if the high-yield savings account you’re interested in charges monthly maintenance fees. Be mindful of what it is as the cost could outweigh the advertised benefits.

Day 23: Set an investment budget

“I generally advise, if possible, people set aside 15 percent of their paycheck to their future self, which means 401(k) and investing,” Lapin says, emphasizing that this should be done after you feel your emergency fund is already in a good place. If you’re new to investing, Lapin advises against buying individual stocks, instead buying an exchange traded fund (ETF) or an index fund, which is a safer bet. (If that last sentence sounded like another language, we feel you—and we recommend taking a gander at The Hell Yeah Group’s WTF are Investments? series.) Then, make investing your budget automatic by signing up for an app like Robinhood, Acorns, Betterment, and Stash, which all do the hard work for you.

Day 24: Listen to a financial podcast

For the uninitiated, investing can be daunting, but there are podcasts that can break it down for you. Lapin has her own podcast and says she’s also a fan of James Altucher’s podcast. Marineau of Credit Karma is really into The Fairer Cents, which often focuses on money topics that specifically affect women. It’s a more engaging way to learn about money without sifting through dense articles on the topic.

Day 25: Do “market research” on your salary

Part of gaining control of your finances involves understanding your earnings potential—because that in turn affects how much you can save and invest. Considering that the average woman makes 80 cents on the dollar that men do (with even larger disparities for minority women), all of us could stand to check in and see if we’re being paid fairly. Check out what the standard salary range is for your job using sites like Glassdoor or Payscale, look up how your company’s finances are doing, and if you’re comfortable, ask coworkers or former colleagues you trust if they’d be willing to share what they make. Do the research now so that you can ask for a raise when the time is right.

Day 26: Find your “budget buddy”

You know how workout buddies can help keep you accountable to your fitness goals? Find the same kind of person for your finances—a budget buddy, if you will. “Commit to checking in with one another every few weeks and swap tips. They’ll help hold you accountable; you’ll help hold them accountable; and you’ll both be that much closer to living the lives you want and deserve,” Torabi previously told Well+Good.

Day 27: Tackle a financial hurdle you’ve been putting off

This is your *last* actionable day of the month before your money date tomorrow. Use 15 minutes today to focus on anything you’ve been putting off. Automating your charitable giving, renegotiating your Spotify subscription, making a list of the expenses related to that upcoming wedding you have, rolling over a prior 401(k)... Whatever has been looming in the back of your mind, crossing it off your mental to-do list will help lower any money anxiety you’ve been feeling. (As de Leon says, a good rule of thumb is to spend no more than 20 percent of your time “freaking out” about your finances—but 20 percent is totally normal.)

Day 28: Have a money date—and set up recurring ones every month

Take a few minutes to reflect on all the progress you’ve made the past month—and do a short gratitude meditation to acknowledge your hard work. Chances are that you’re a heck of a lot more organized than you were in 2019. And know this is just the beginning of your year of making peace with your finances. End the challenge by putting a reoccurring money date on your calendar for once a week. That way, you keep up all your good intentions all year long.

*By signing up, you’ll also be added to our Well+Good newsletter.

Curious about trying out our other Renew Year plans? You're just 28 days from being stronger than ever—or from having healthier eating habits.

Loading More Posts...