The Easy Financial Habits to Form in 2019 That Will Pay Off Big Time

Chase Financial Education Ambassador Farnoosh Torabi is here to help you make dollars and cents out of your financial goals for the year ahead. Embark on a four-week journey in which she helps you assess your current situation, plan for what's ahead, and set yourself up for financial success throughout the rest of the year.

However many of your 2018 to-dos remain undone—and no matter how many glasses of Champagne you drank on December 31—January 1 still manages to feel like a fresh start. The pages of your brand-new planner are clean, crisp, and totally blank; and 12 gloriously empty months stretch out in front of you, open to all kinds of possibilities. Maybe you’ll move to a new city, or leave a job you can’t stand, or run a marathon. Or maybe you’ll dedicate 2019 to (finally) getting your finances in order.

With most goals—but especially when it comes to your personal finances—it’s easy to set yourself up for failure by only giving yourself a week or a month to create new habits or change bad behavior. But a whole year? That gives you enough time to make some strides. Especially if you start strong in January, and especially if you get specific about what it is you want to accomplish.

I’m a big believer in setting smaller goals along the way—they can create a lot of momentum to help you feel confident about doing the bigger stuff. So instead of saying, “I want to get out of credit card debt,” or, “I want to build up my savings,” take a look at your calendar and break that big goal into smaller, more manageable ones. Think: “This month, I want to pay off the lowest-balance credit card,” and work from there.

{{post.sponsorText}}

Keeping it specific is only going to make you more focused. So is sticking to a schedule, which is why I’ve outlined a week-by-week guide to see you through the first month of 2019 that'll help set you up to make your big plans a reality by the end of the year.

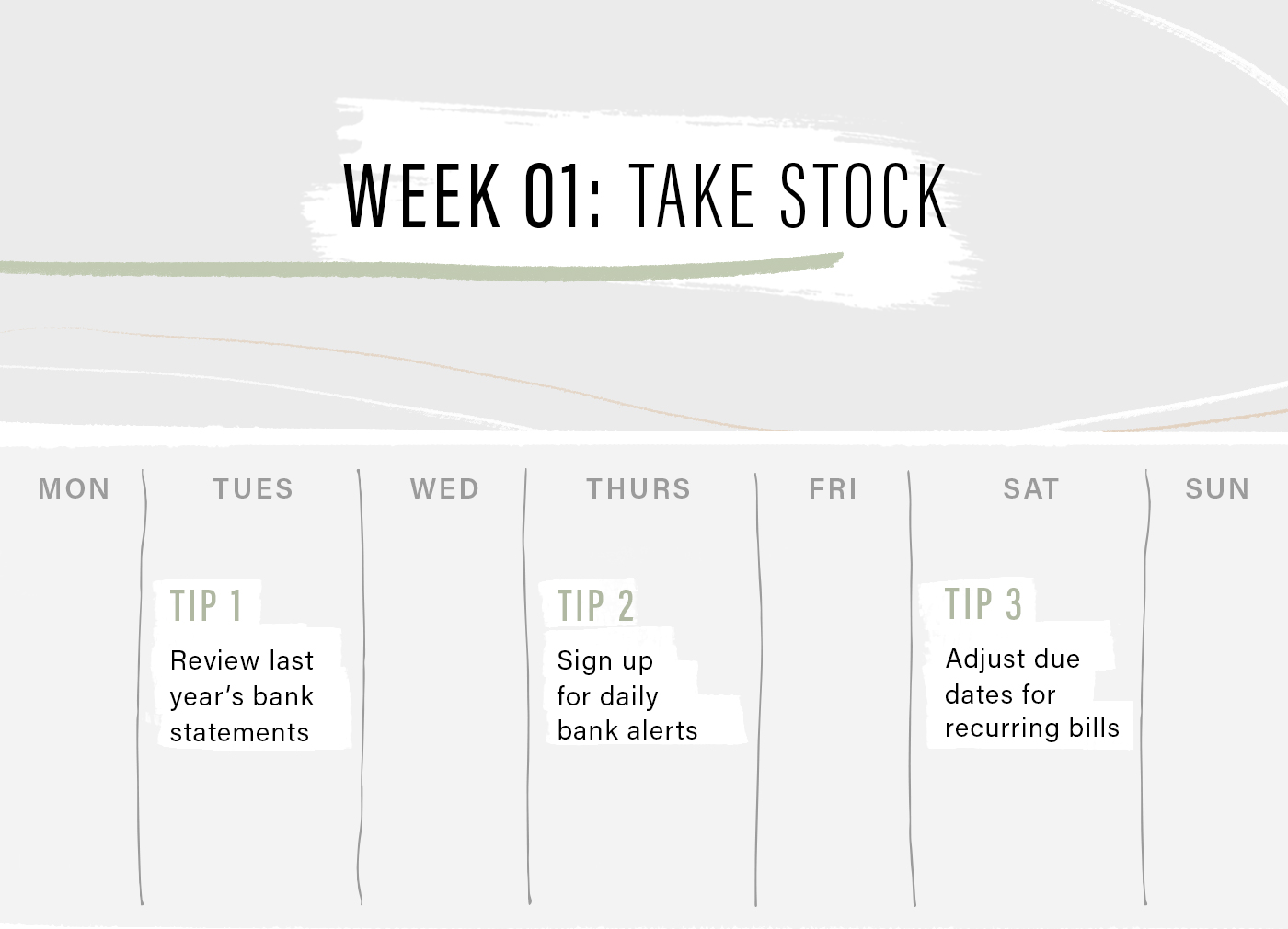

Week 1: Take stock

You can’t know where you’re going if you don’t know where you’ve been. Taking an honest look at your financial standing can be a very emotional process for some people, but it has to happen before you can start building. This week, try three exercises to get a clear picture of your financial history and habits.

Tip 1: Add it all up

Comb through last year’s bank statements, credit card statements, pay stubs and loan information. Get clear about what you owe, what you have in savings, and how much income you’re bringing in. To get a handle on your debt, it can be helpful to speak with a credit counselor at an organization like the National Foundation for Credit Counseling or Money Management International. But you can also check your credit score on your own: Turbo shows you your debt-to-income ratio, while Credit Journey℠ from Chase shows you both the positive and negative factors impacting your score so you can see where changes should be made and where you should keep up the good work.

Tip 2: Make a habit of checking your bank account

Small things can have a big impact. For example, even the simple act of checking your bank account balance every day will give you more of an awareness of (and make you more invested in) your financial life. It takes about 30 days to really adopt a new behavior, so practice every day, then check in with yourself at the end of the month.

Tip 3: Give yourself breathing room by adjusting due dates

It can be really overwhelming if it seems like everything is due on the same day or during the same week of the month. Consider calling up your credit card company (or your student-loan servicer, or your gym, or wherever else you have recurring bills) and ask for new due dates, just to spread out your expenses a little more.

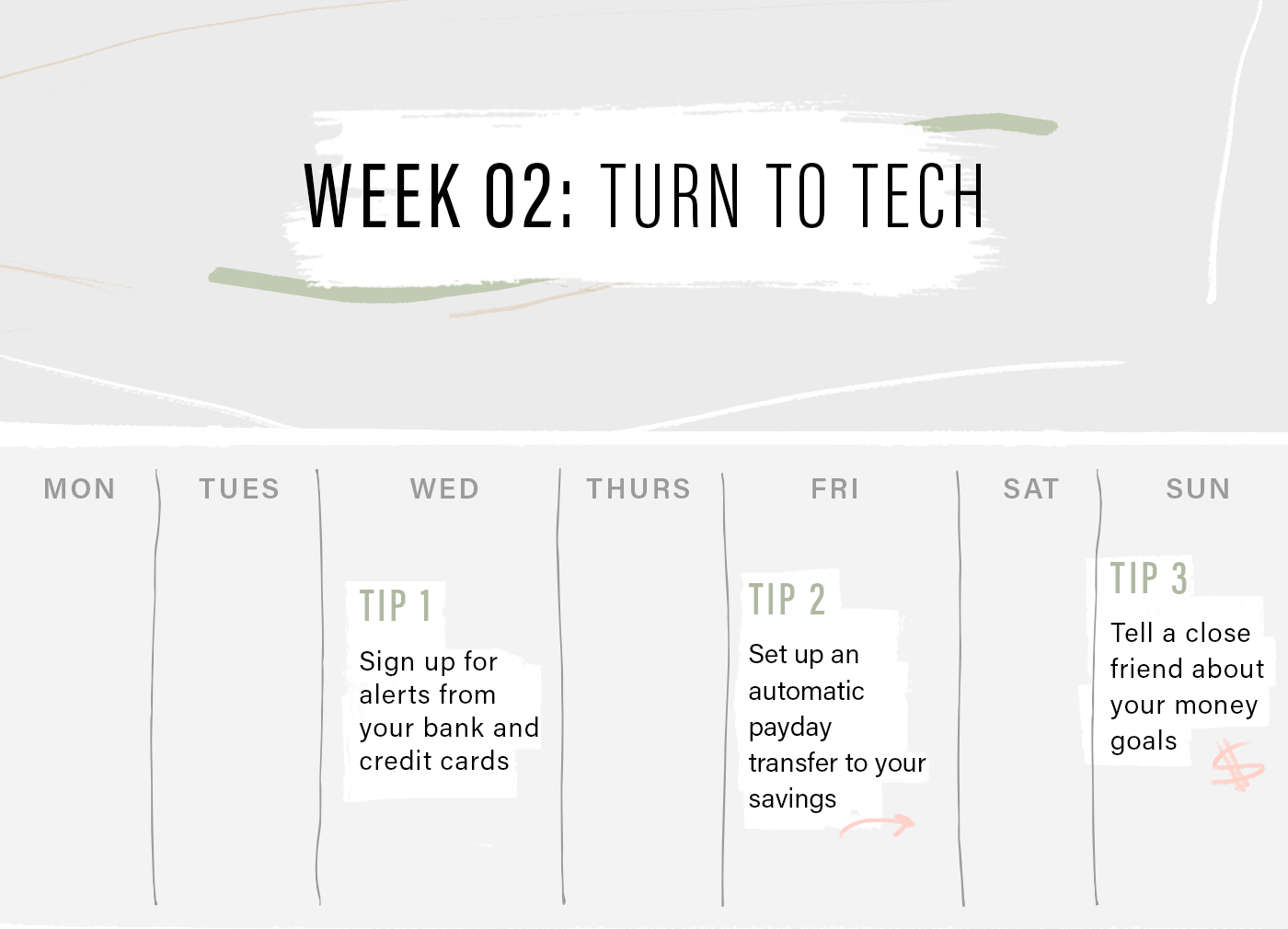

Week 2: Turn to tech

When it comes to getting your money in order, technology is your new best friend. It can help you pay bills on time and hold you accountable when you make not-so-great choices. (Hey, it happens.)

Tip 1: Set all the alerts

Banks like Chase make it easier than ever to track your balances and spending. If you don’t already have the apps for your banks and credit cards, download them, and sign up for available alerts. It’s easy to feel overwhelmed by push notifications and alerts, but if there’s one to opt into, it should be your bank. If your bank is alerting you of something, it’s probably important. Sign up for low-balance alerts, overdraft alerts, fraud activity alerts—if it's offered, sign up for it.

Tip 2: Autopay it forward

Signing up for autopay on your recurring bills can be a really valuable resource, if you're comfortable using it. You don’t ever have to write a check or be responsible for remembering a due date—autopay takes care of all of that. There are so many benefits, but the biggest one is that you’re paying your bills on time, which means you’re never going to have to deal with late fees—or the dings to your credit history.

On the flip side, you can also use an app like Digit to help automate your savings.

Tip 3: Find your people

Digging yourself out of a bad spot can feel really isolating. So, just like you’d find a gym buddy, find a money buddy—someone who’s also focused on improving their financial situation. This person doesn't have to share your same goal, but you'll still have somebody with whom you can talk openly about finances. You can trade tips, keep each other on track, and celebrate your successes.

Your money buddy doesn’t necessarily have to be somebody you know IRL. Shameless plug: I have a podcast, and I’m definitely not alone. There’s a ton of free financial content that you can independently tap into. You don’t need to lean on traditional experts, either—maybe there’s a writer you really like who has gone through their own debt repayment journey and blogged about it. When you find a blog, a social media account, or a podcast that really speaks to you, you’re becoming part of a community of lots of people who are like you. Following (and commenting) along helps reinforce the idea that you’re not alone in this.

Week 3: Check yourself

We’re all human and we all get a lot of pleasure out of treating ourselves. The trick here is to separate the stuff that might provide a rush now from the stuff that actually will make you happier in the long run.

Tip 1: Curate your feeds

Social media can be a great place to turn for support and inspiration, but it can also end up being a pretty big source of temptation. Especially Instagram. It’s where a lot of people (me included!) spend time these days, but there are a ton of targeted ads, not to mention celebrities showing off watches, purses, what have you. But your favorite reality star’s sponsored posts aren’t the only thing that can do damage—certain friends’ accounts can be just as tempting. It’s easy to convince yourself that while your life might not be as fabulous as theirs, it would be if only you had that piece of jewelry, or went on that trip, or ate at the same pricey restaurant.

I’m not saying you have to unfollow anyone—just mute them until you get a good thing going with your money. Or, if you’re somebody who’s especially prone to late-night, online shopping rabbit holes, create some new rules for yourself. Like: “I’m going to leave my phone in the other room overnight, because I’m just too tempted to start scrolling.”

Tip 2: Run the numbers

Take a close look at last year’s bills and bank statements. Notice any patterns? A few Januarys ago, I noticed how much my husband and I were spending on Seamless. On the hierarchy of our bills, it was like...our mortgage, and then food delivery. It was kind of embarrassing. On one level, I knew we were spending a lot, but if you’re paying $30 or $40 at a time, you don’t necessarily think about it. All of that is to say, whatever your version of Seamless is—maybe you love shoes, or maybe you take Uber more often than you need to—remember that it’s never just an isolated purchase. Those little amounts add up, but they can also be a slippery slope. You’re buying this one thing now and it feels like no big deal, so next week, you spend on a few more things you probably don’t need.

Tip 3: Take a minute

If something awesome catches your eye while you’re browsing and you have. to. have. it, go ahead and add it to your cart—but then make yourself wait 24 hours before you actually click “purchase.” Sometimes it helps to put something in your shopping bag and then walk away from your laptop or smartphone. A little bit of distance can mean the difference between buying irrationally and giving your responsible, logical side the chance to kick in and remind you that you don’t actually need that.

If temptation gets the best of you, don't be too hard on yourself. When you slip up, you feel guilty, and the guiltier you feel, the more negative you get, and the more negative you get, the more you start to feel like making a big change is impossible. Which isn’t true! So instead of beating yourself up, move on. If you make a mistake, acknowledge it and focus on what you can accomplish tomorrow. And then maybe call your money buddy for some encouragement.

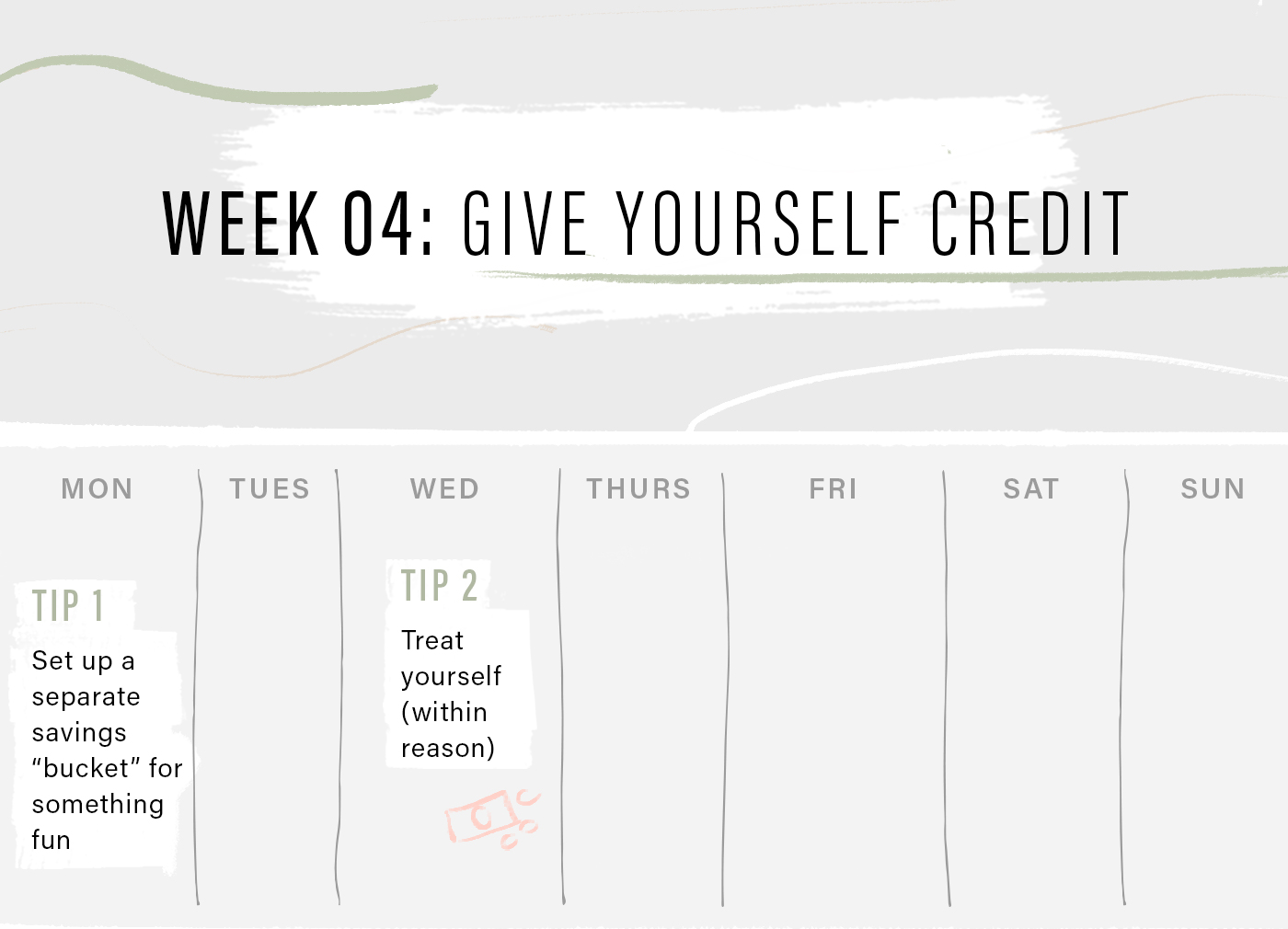

Week 4: Give yourself credit

Making real, lasting change is hard work, and you’ve been at it for almost a month now. So take some time now—and at the end of every month—to think about how far you’ve come and how you can keep growing and improving.

Tip 1: Up your savings game

If you’ve built up a solid emergency savings fund, take it to the next level by creating different savings buckets. (You can keep track on your own, although your bank may give you the option of splitting your money between several different categories.) Keep saving for emergencies and big life stuff—don’t forget to pay yourself first by putting a certain amount aside when payday rolls around—but introduce categories for the “nice to haves,” like a big trip overseas or a new sofa, and contribute a little bit to those, too. It all adds up.

Tip 2: Celebrate small wins

You can (and should) reward yourself when you hit certain benchmarks. The most important thing is to plan for it, so it doesn’t turn into, “Oh, it’s Friday, I’ve had a good day at work, I’m going to go buy a new dress.” You want it to be tied to an achievement, and you want to be absolutely sure it’s in budget. While you’re working on saving, try to set aside $5 or $10 every week, so that by the end of the three months, you can go treat yourself to a nice dinner, or a concert, or some kind of experience, which studies show can actually make you happier over time.

Before you know it, 2019 will be on its way out. But once you’ve proven to yourself exactly what you’re capable of doing, you can go into 2020 with the bar set even higher.

If you're feeling inspired to dive even deeper into how to make real, lasting change in 2019, check out our ReNew Year program for endless inspo.

Loading More Posts...