How a 24-Year-Old Balances Saving for Her Wedding While Paying Off Student Loans

Talking about money with friends and acquaintances may seem like a faux pas, but if there’s any time to tear down that stigma, it’s now. For many, the effects of life amid the COVID-19 pandemic have been financially destructive, making budgeting for healthy habits difficult, if not almost impossible. That’s where Well+Good’s Checks+Balanced series comes in. Think of it as a space to inspire more open and frank conversations around money—especially regarding how different people are able to afford the wellness habits that are important to them.

For Danielle, paying off student loan debt is hard enough to budget for, but in adding in the need to save for her upcoming wedding, tracking expenses became even more important to her. It's a major reason why she—a publicist living in Boulder, Colorado—decided to keep her bartending job years after graduating college. Having the extra money come in makes getting that monthly loan payment a little easier to face.

The extra income also helps Danielle budget for the healthy habits that help her feel like her best self. She has rheumatoid arthritis and says she's noticed a correlation between the types of foods she eats and how physically active she is to the severity of her symptoms. Here, Danielle explains exactly how she makes it all work.

Keep reading to see how Danielle balances budgeting for her favorite healthy habits and her upcoming wedding while prioritizing paying off her student loans.

*Danielle, 24, publicist and bartender, Boulder, Colorado

Income: $65,400/year. I graduated college in 2018 and work in public relations, making $55,000 a year. A lot of my clients are healthy food brands—there are so many based right here in Boulder! In addition to my full-time job, I work as a bartender one night a week for extra money at a local restaurant. I make about $200 a week bartending. I actually started working at the restaurant when I was 16 as a host and server, so I've been working here a long time.

{{post.sponsorText}}

The pandemic has changed the restaurant industry, and many of my colleagues have been severely affected. Our restaurant closed down entirely when COVID-19 began to spread widely, and we began only offering curbside takeout. We've completed a specific state certification to comply with COVID-19 restrictions, meaning we're now allowed to have some guests in the restaurant. That said, we still recommend takeout ordering, and all guests who do dine in must wait in their car before being seated to avoid coming in close contact with each others currently eating at or leaving the restaurant.

My restaurant has been fortunate that the local community has really supported the business. Since I only work once a week, my income from the restaurant hasn't changed much, but many of my friends [who rely on service-industry jobs more heavily] have lost a lot of money during the pandemic. Ultimately, I'm looking forward to the day when can all eat together safely again.

Housing: $800/month. I live in a one-bedroom apartment with my fiancé, and we split our rent right down the middle, totaling at $800 a month each. We actually split all pretty much our bills down the middle like that.

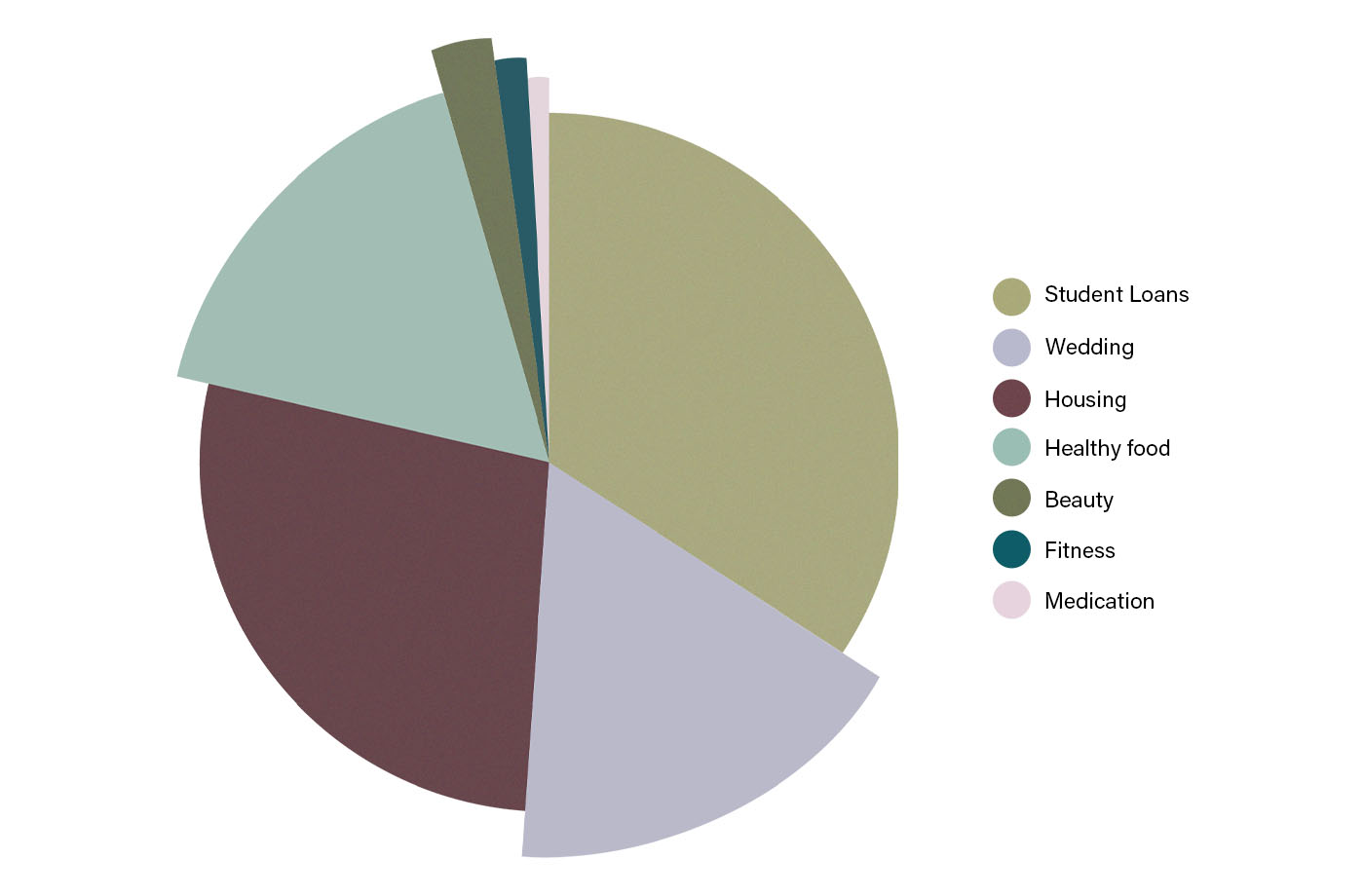

Other recurring expenses: $1,680/month. I just got engaged, so my fiancé and I are both saving for our wedding, which we hope to be able to safely have next year. We both contribute $500 a month to our wedding fund. Besides the wedding, one of my biggest expenses is paying off my student loans. I pay $1,000 a month toward them—which is more than I spend on anything else.

My fiancé and I also bought a pandemic puppy, a little Labrador mix. Between food and toys, I spend about $100 a month on the dog. My only other recurring expenses are Wi-Fi and utilities, each $40 per month for my half. I got rid of my car during the pandemic, so I don't have any transportation costs (Boulder is really walkable). I also use my parents' Netflix account, which I don't pay for.

Healthy food: $500/month. I don't follow a specific diet, per se, but I do have rheumatoid arthritis, and I've found that when I don't eat foods that are highly processed or have a lot of sugar, my symptoms aren't as severe. I try to eat on the healthier side, and I do most of my grocery shopping at Trader Joe's spending about $100 a week. I buy lots of vegetables, fruits, and packaged foods made with whole food ingredients. My fiancé works at a restaurant and eats a lot of his meals at work, so I definitely buy more groceries than he does. We also order takeout about once a week, which costs about $25 each.

Fitness: $21/month. Boulder is definitely a very active place to live, and I like to take advantage of that by going for hikes or runs when the weather is nice. My new dog makes sure I get plenty of time outside, too. The only fitness-related activity that I pay for is a $21 monthly subscription to Obé Fitness, which is a virtual platform that has a whole bunch of different types of fitness classes, offering both live and on-demand classes.

Beauty: $960/year. I spend about $50 a month on skin-care products and try to prioritize buying products that are all-natural. The one beauty habit I do prioritize is getting facials a couple of times a year, which is $100 each time. To me, it's just as much of a self-care moment as it is a beauty one. I also get my nails done about four times a year, which is $40 each time.

Medication: $260/year. I take a prescription medication for my arthritis. My insurance pays for some of it, but it costs $65 each quarter out of pocket.

My biggest money goals right now are paying off student loans and budgeting for my wedding, but buying foods that won't cause arthritis flare-ups and finding affordable ways to stay active will always be a priority to me. I'm grateful to have a second job that helps make budgeting a little easier than it would be otherwise. It's definitely worth the extra work!

*Last name has been withheld.

Want to be featured? Email emily@www.wellandgood.com.

Oh hi! You look like someone who loves free workouts, discounts for cult-fave wellness brands, and exclusive Well+Good content. Sign up for Well+, our online community of wellness insiders, and unlock your rewards instantly.

Loading More Posts...