Checks+Balanced: How Going From a High-Paying Job to Start-up Life *Really* Changes a Budget

Even in a world where questions about menstrual cups and the ins and outs of sex are completely (and blessedly) normal, somehow the ever-ubiquitous use of money remains a touchy subject for many. People want to live their healthiest life ever, but—#realtalk—it can add up. Have you ever wondered how your colleague who makes less than you do (or so you think) can afford to buy a $5 matcha and a $12 chopped salad every day? Or how your friend’s budget allows her to hit up $34 fitness classes three times a week? It’s enough to make anyone want to ask, “Ummm, excuse me. How do you afford that?!?”

That’s where Well+Good’s monthly series Checks+Balanced comes in. By lifting the thick, tightly drawn curtain to expose how much women of varying income brackets spend on wellness, we’re spreading transparency and hopefully providing some inspo that’s possible to copy. Because no matter how much you make, it’s possible to cultivate healthy habits that work within your budget.

This month, Elizabeth Giannuzzi, a 29-year-old living in San Francisco, reveals how her spending habits changed after leaving a high-paying job in finance to launch her food startup, Siren Snacks. With wellness being a major priority for Giannuzzi, being able to afford the start-up costs meant deciding what she could sacrifice—and what she would find a way to pay for, no matter what. (Spoiler alert: She's been dishing out for way fewer spin classes.) Keep reading to see how her budget looks now.

{{post.sponsorText}}

Here, a 29-year-old entrepreneur living in San Francisco shares how she affords wellness habits while balancing the costs of launching a business.

Elizabeth Giannuzzi, 29, co-founder of Siren Snacks, San Francisco

Income: $65,000 per year. I used to work in investment banking, making double what I do now. In my early twenties, I navigated a number of health challenges and was diagnosed with an inflammatory autoimmune disease called dermatomyositis, which basically means my immune system attacks my skin and muscle tissues. The diagnosis was a wake-up call for me to start prioritizing my health and think more about what I'm eating. I became fascinated with the connection between nutrition and health, and I ultimately left my job in finance to start a plant-based protein snack company with my sister. We didn't pay ourselves a salary for the first year and a half, so I had to cut down on my spending drastically during that time and live off my savings. We now feel comfortable paying ourselves salaries, though it's still much less than I made in banking.

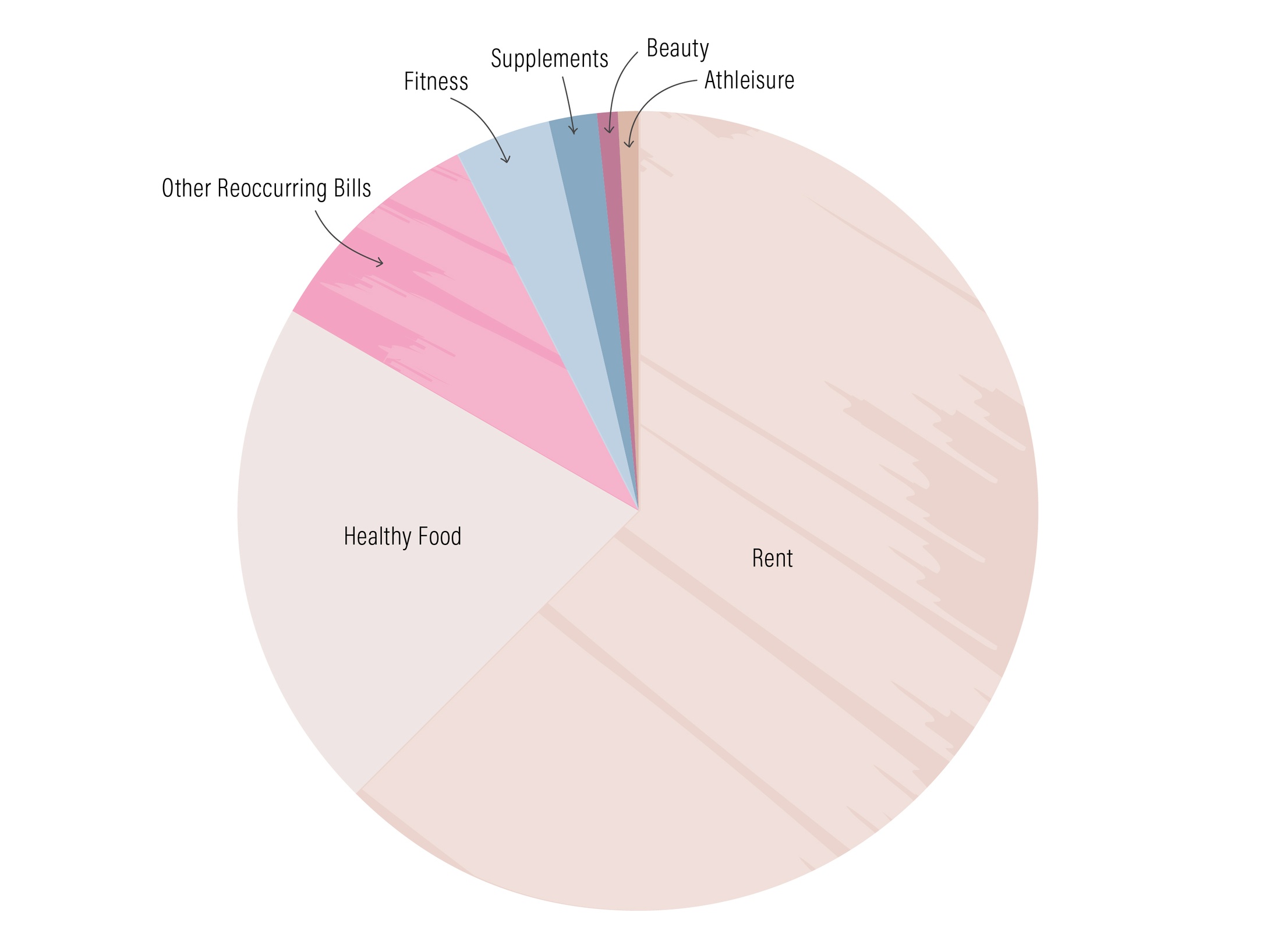

Rent: $1,500 per month. I live in a one-bedroom apartment with my fiancé, near our friends and family, and we each pay $1,500.

Other reoccurring expenses: $224 per month. My sister and I share a car and we both pay about $150 per month on car-related expenses, including gas. My fiancé and I each pay about $60 a month for our utilities bill, and we also have subscriptions to Netflix and HBO Go, which we split.

Food: $500 per month. Eating healthy food is definitely something I prioritize, and I do spend quite a bit on high-quality groceries. I buy some foods in bulk from Amazon, like nuts and seeds, and at Trader Joe's, I get produce and healthy frozen food. When I worked in finance, I used to eat out more and would regularly buy $15 salads for lunch, but now I make pretty much all of my meals at home. My fiancé works half the week in another city, so we split our food expenses when we're eating out together, but I tend to use my own money when I buy groceries solo.

Fitness: $90 per month. I used to go to Barry's Bootcamp and SoulCycle four to five times a week. Now, I go about twice a month. I got a subscription to the fitness-streaming platform Obe Fitness, which costs $30 a month. It offers all sorts of classes has really helped me save money on fitness without needing to cut back on my workouts.

Supplements: $50 per month. I spend about $50 a month on supplements, including iron, probiotics, and vitamin B12.

Beauty: $200 per year. I'm pretty low-maintenance when it comes to my beauty routine, spending about $200 a year total on beauty products. I also do my own nails and don't get my hair done very often.

Athleisure: $200 per year. I really only buy something if there's a good sale happening. Otherwise, I ask for cute leggings or workout tops as a gift for my birthday or holidays.

Want to be featured? Email emily@www.wellandgood.com. And if you, too, dream of leaving your nine-to-five gig to launch your own business, here are some tips.

Loading More Posts...